Kolkata: British American Tobacco (BAT) is awaiting Reserve Bank of India (RBI) approval before it can sell its 15.29% shareholding in ITC Hotels. BAT is ITC's single largest shareholder.

This is required as the ITC holding dates back to the early 1900s, BAT chief executive Tadeu Marroco told analysts on an earnings call last week.

Unlocking Shares

"Sometimes things take longer for us to be able to unlock those shares, get the right approvals in the right forums," he had said. "In this case, it's the central bank in India, in order to be able to transact."

Once this comes through, BAT will embark on selling the holding as it will help the company return to the corridor of 2-2.5x adjusted net debt/ebitda by the end of 2026. "We intend to use the proceeds of the hotel to deleverage further the company," he said.

The hotels business was demerged from ITC in January. Under the plan, ITC shareholders hold 60% of the unit with the rest owned directly by ITC.

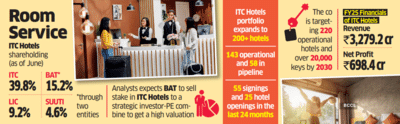

As a result, BAT owns 15.29% in ITC Hotels as a foreign direct investment, making it the largest public shareholder after ITC's promoter holding of 39.87%, as per the shareholding pattern at the end of June.

As of June, ITC Hotels had a portfolio of over 200 hotels-143 operational and 58 in the pipeline.

Analysts tracking the company said RBI's approval is required since this deal involves a foreign company selling its shares in an Indian company and taking the money out of India. They added that it could also have something to do with ITC being a tobacco company and FDI not being allowed in the segment. Marroco said BAT wants to divest the stake as it "strategically" doesn't want to be in the hotel business.

Capital Flexibility

BAT recently reduced its holding in ITC through two block deals after receiving RBI approval-in February last year (3.5%) and May this year (2.5%)-lowering its holding in the cigarette-to-FMCG major to 22.93% from 29%.

Marroco said in the latest earnings release that BAT's continued strong cash conversion and the recent partial monetisation of its ITC stake has enhanced its capital flexibility. The company received 1.1 billion from the May stake sale, which increased its share buyback for 2025 from 0.9 billion to 1.1 billion.

BAT declared that as part of the demerger accounting of ITC Hotels, ITC recognised the excess of the fair value over the carrying value of the hotels business as an adjusting item. BAT's share of this adjusted gain amounted to 333 million (net of tax), it said in the earnings release.

This is required as the ITC holding dates back to the early 1900s, BAT chief executive Tadeu Marroco told analysts on an earnings call last week.

Unlocking Shares

"Sometimes things take longer for us to be able to unlock those shares, get the right approvals in the right forums," he had said. "In this case, it's the central bank in India, in order to be able to transact."

Once this comes through, BAT will embark on selling the holding as it will help the company return to the corridor of 2-2.5x adjusted net debt/ebitda by the end of 2026. "We intend to use the proceeds of the hotel to deleverage further the company," he said.

The hotels business was demerged from ITC in January. Under the plan, ITC shareholders hold 60% of the unit with the rest owned directly by ITC.

As a result, BAT owns 15.29% in ITC Hotels as a foreign direct investment, making it the largest public shareholder after ITC's promoter holding of 39.87%, as per the shareholding pattern at the end of June.

As of June, ITC Hotels had a portfolio of over 200 hotels-143 operational and 58 in the pipeline.

Analysts tracking the company said RBI's approval is required since this deal involves a foreign company selling its shares in an Indian company and taking the money out of India. They added that it could also have something to do with ITC being a tobacco company and FDI not being allowed in the segment. Marroco said BAT wants to divest the stake as it "strategically" doesn't want to be in the hotel business.

Capital Flexibility

BAT recently reduced its holding in ITC through two block deals after receiving RBI approval-in February last year (3.5%) and May this year (2.5%)-lowering its holding in the cigarette-to-FMCG major to 22.93% from 29%.

Marroco said in the latest earnings release that BAT's continued strong cash conversion and the recent partial monetisation of its ITC stake has enhanced its capital flexibility. The company received 1.1 billion from the May stake sale, which increased its share buyback for 2025 from 0.9 billion to 1.1 billion.

BAT declared that as part of the demerger accounting of ITC Hotels, ITC recognised the excess of the fair value over the carrying value of the hotels business as an adjusting item. BAT's share of this adjusted gain amounted to 333 million (net of tax), it said in the earnings release.

You may also like

Calcutta HC has highest backlog of cases pending for 50+ years

ITV viewers 'feel sorry' for Katie Price as daughter Princess' new reality show airs

Stunned EasyJet passengers spot 'drunk and naked' pilot in bar before flight

Trevoh Chalobah injury update after Chelsea suffer another blow in pre-season

Netflix fans convinced they've identified Tyler's new master after Wednesday Season 2 part 1 finale