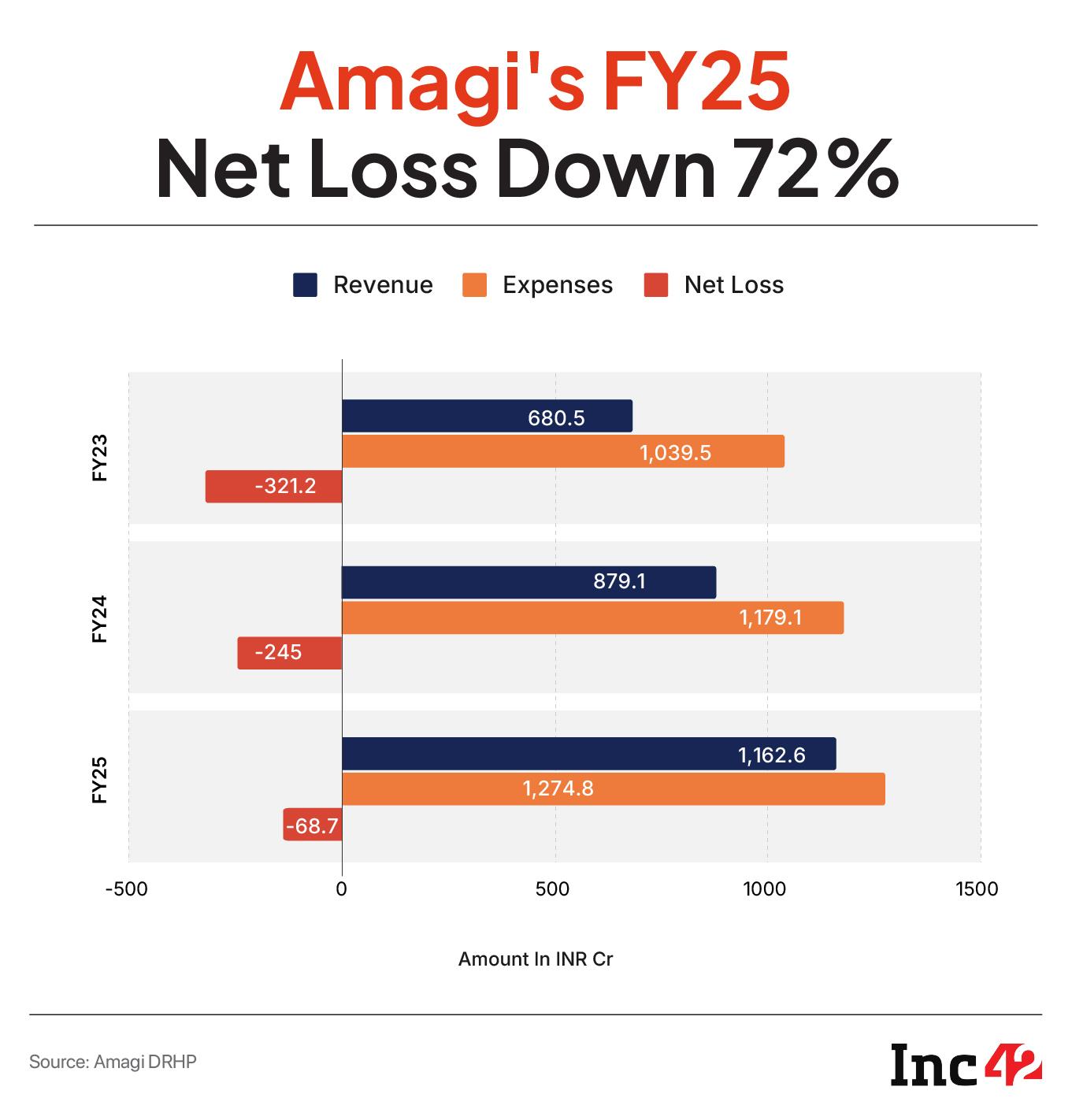

Media SaaS unicorn Amagi saw its consolidated net loss narrow 71.9% to INR 68.7 Cr in the financial year ended March 2025 (FY25) from INR 245 Cr in FY24, as it managed to control its expenses and saw a strong growth in top line.

The company’s revenue from operations zoomed 32.2% to INR 1,162.6 Cr in FY25 from INR 879.1 Cr in the previous fiscal, as per its DRHP filed with markets regulator SEBI.

Founded in 2008 by Baskar Subramanian, Srividhya Srinivasan, and Srinivasan KA, Amagi Media Labs is a media technology company that enables television broadcasters and content owners to manage and monetise their content through a cloud-native infrastructure.

Amagi offers a platform that facilitates content preparation, channel creation, OTT distribution, and advertising delivery, replacing traditional broadcast workflows with flexible, software-driven systems.

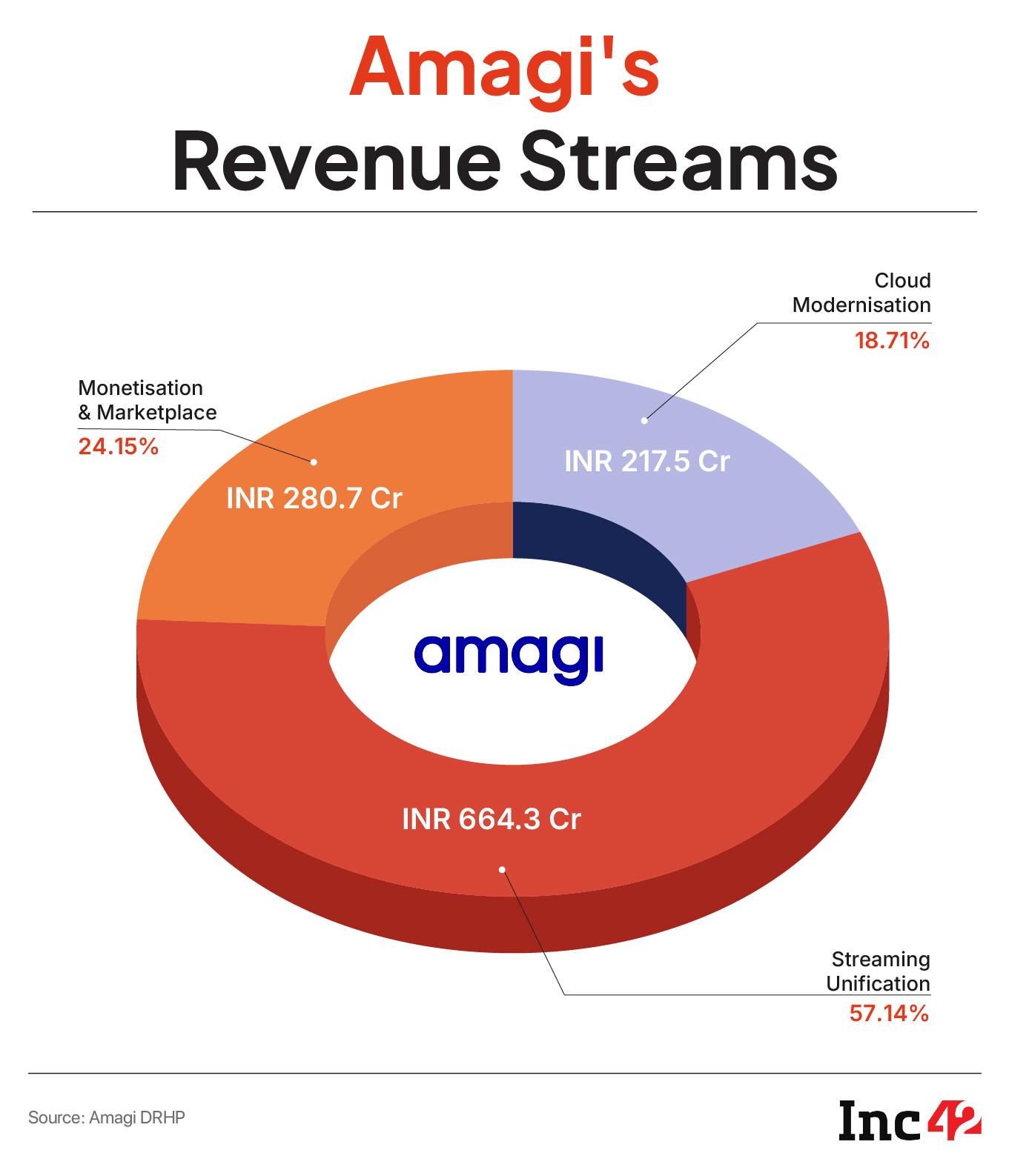

The company divides its operations into three segments – cloud modernisation, streaming unification, and monetisation and marketplace.

Cloud Modernisation: This division focusses on transitioning legacy broadcast systems to cloud-based infrastructure. Rather than relying on costly and rigid hardware setups, broadcasters can use Amagi’s platform to manage channel playout, content scheduling, and distribution from the cloud.

This offers operational efficiency and scalability, particularly for global media companies looking to reduce capital expenditure and operational overhead. According to the DRHP, customers shifting to the cloud can reduce the total cost of ownership by up to half over five years.

During FY25, cloud modernisation accounted for 18.71% of Amagi’s revenue from operations at INR 217.5 Cr.

Streaming Unification: This is the largest business segment for the company. Through it, Amagi helps its clients manage and distribute content across all formats – video on demand, ad-supported models, and free ad-supported streaming television – from a single interface.

It provides tools for scheduling, encoding, delivery, and analytics, ensuring that content owners can operate channels across platforms like Roku, Samsung TV Plus, and others without having to manage separate workflows.

At INR 664.3 Cr, the streaming unification division generated 57.14% of Amagi’s total operating revenue in FY25.

Monetisation & Marketplace: This division helps clients generate revenue from their content. It offers advertising services, such as dynamic ad insertion, targeting, and campaign analytics, and a content syndication marketplace that facilitates licensing deals across platforms.

Amagi not only enables technical delivery of ads but often participates in revenue-sharing arrangements, particularly on FAST channels, where it acts both as a service provider and monetisation partner.

This segment taps into the growing programmatic advertising market and the increasing demand for connected TV inventory. It is a key driver of margin expansion and top line growth when digital advertising demand is strong. In FY25, this division brought in a revenue of INR 280.7 Cr, or 24.15% of Amagi’s total revenue from operations.

Breaking Down The ExpensesAmagi’s total expenses for the period under review stood at INR 1,274.8 Cr, rising a mere 8.1% from INR 1,179.1 Cr in FY24.

Employee Benefit Expenses: The company’s employee expenses grew 4.7%to INR 694.8 Cr in FY25 from INR 663.4 Cr in the previous fiscal year.

Notably, employee benefit expenses accounted for 54.5% of the company’s total operating revenue during the year under review as against 56.2% in FY24.

Communication Costs: Amagi’s expenses under this head grew 34.5% to INR 364.1 Cr from INR 270.6 Cr in the previous year.

Membership & Subscription Expenses: The company’s spending under this head grew 9.3% to INR 45.4 Cr from INR 41.5 Cr in FY24.

Amagi Eyes Public ListingLast week, the unicorn filed its draft IPO papers to raise up to INR 1,020 Cr via a fresh issue of shares. Besides, the public issue will comprise an offer-for-sale component of up to 3.41 Cr shares.

Norwest Venture Partners, Accel India, Trudy Holdings, Premji Invest, Avaatar Ventures Partners and some angel investors are set to offload their shares through the OFS. Of these, Premji Invest plans to sell the highest number of shares at 1.42 Cr.

The company is also eyeing a pre-IPO placement round of up to INR 204 Cr.

Amagi will use the proceeds from the fresh issue for strengthening its technology and cloud infrastructure. The company is also looking at potential acquisitions for inorganic growth.

The post IPO-Bound Amagi’s Loss Narrows 72% To INR 69 Cr In FY25 appeared first on Inc42 Media.

You may also like

Mumbai's Byculla Zoo Releases 'Waghobachi Goshta' Video On Occasion Of International Tiger Day

Farah Khan Overjoyed As Amitabh Bachchan Sends Handwritten Letter: 'Written At 3:30 AM, Amit Ji Watches Our Vlogs' (VIDEO)

Water bill waiver scheme: How long will 16 lakh people in Delhi have to wait? Know where the scheme is stuck

WhatsApp: The most awaited feature is coming, you can use Instagram DP in WhatsApp.

'I swapped student life in the UK for Caribbean island - and saved myself £88k in tuition fees'